It’s February, the ground hog saw his shadow, so there are 6 more weeks of winter. One way to make the most of those dreary days is to review your financial plan; specifically, the core of your finances: your income and spending. You are going to need much of this information for tax season anyway, why not use it to get a clearer picture of your financial life?

Gathering Information

Start by collecting your income details. Your W-2 or 1099s from employers will show earnings and taxes paid. Statements from your investment accounts and IRAs provide a year-end summary of contributions and withdrawals. Your bank statements will reflect deposits, transfers, and checks written. Credit card companies and bank statements often include a year-end report that categorizes all your spending. You can also download this data on their website into an Excel file that makes it easy to add everything up.

Categorize

Break your finances into clear categories: income, by type, i.e., salary/wages, bonus, dividends, interest, capital gains, retirement distributions, social security, etc. List your spending; use your credit card year-end summary and bank statements to identify key expenses categories: Fixed Expenses: Monthly and annual bills such as rent/mortgage, utilities, and insurance. Necessities: Food, transportation, medical expenses Discretionary Spending: Clothing, subscriptions, some online purchases. A category of its own is Travel: Hotels, flights, transportation, and dining.

Analyze

Once you have a complete picture of your financial activity, take a step back and ask yourself: did I spend in the categories intended? Overspend in certain areas? Save enough? Was anything left over to invest and how much did my money grow last year. Having this information available helps you to plan your spending so you can accomplish more with your money: What is your Budget for this year? or better: How do you want to spend your money so you can achieve your goals?

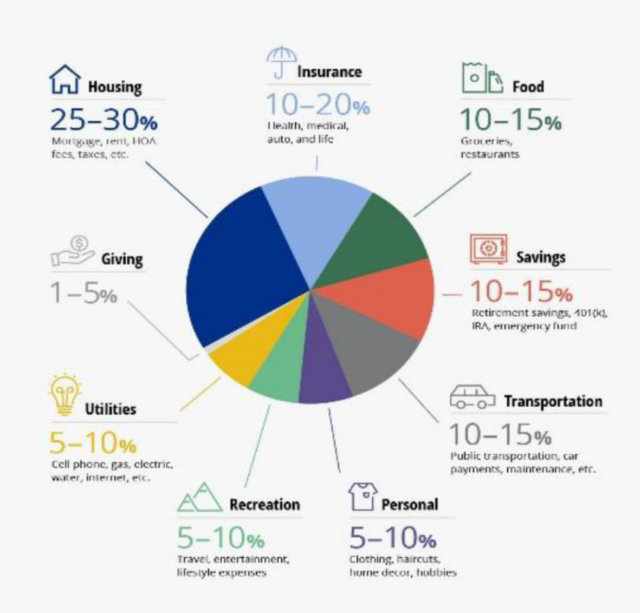

A typical budget might look like this:

Create a Budget or Spending Plan

Creating a budget is the first step to financial stability and understanding your larger financial picture to make sure you’re meeting your financial goals. Using percentages can make budgeting flexible, adjusting as your income changes.

Budgeting Software

There are many software programs available to help with budgeting. Most of them automatically gather financial information from your banks, credit card companies, and investment accounts, making it easier to track your income and spending.

However, with so many options, finding the right app can be challenging. Here are a few apps that our clients mentioned:

- Quicken Simplifi: considered one of the easiest to use. Monthly cost: $6/m. It tracks spending and Investments. Links to bank accounts. Mobile app: iOS, Android

- YNAB (You need a budget): lets you plan ahead for every dollar you earn. It focuses on pro-active budgeting and long-term planning Monthly $14.99 or $109/yr.

- EveryDollar: a bit similar, but said to be easier than YNAB – a free version lets you get started with more features in the paid version.

- Goodbudget: for hand-on envelope budgeting – free or premium for $10/m or $80/yr

- Copilot.money: uses AI-powered spending categorization and is praised for its sleek design and evolving features. Monthly cost: Starts at $8/m or $95/yr. It tracks spending, Investment tracking, Links to bank accounts and has Mobile app: iOS

If you’re looking for more options, a quick Google search for “Best Budgeting Apps” will provide plenty of reviews comparing features and pricing. Some apps are free, and annual subscriptions often come at a discount.

You can use them on your phone or tablet, but also on your laptop or computer desktop. Most of these tools are available on smartphones, tablets, and desktops, giving you control over your budget no matter where you are. And there is always paper and pencil if you are so inclined.

Take charge of your spending, and you’ll gain greater peace of mind in your financial life.