Your health insurance isn’t a “one-and-done” deal. You need to revisit your coverage at least once a year and ask yourself, has something changed in my medical needs, doctors, network or prescriptions.

Your health insurance isn’t a “one-and-done” deal. You need to revisit your coverage at least once a year and ask yourself, has something changed in my medical needs, doctors, network or prescriptions.

October is open enrollment month not just for Medicare but also for workplace health insurance and benefits across the country. Medicare open enrollment runs from October 15 through December 7 each year. The changes you make during open enrollment will begin on January 1 of the following year.

It’s too soon to know what Medicare premiums will be in 2022. The base Part B premium, plus the Income-Related Monthly Adjustment Amount (IRMAA), will be announced in November. But keeping in mind that the 2021 premium was artificially reduced to 25% of the normal amount as part of a Covid relief bill, this means there will be a claw back of that amount plus the usual increase based on projected expenses for the coming year.

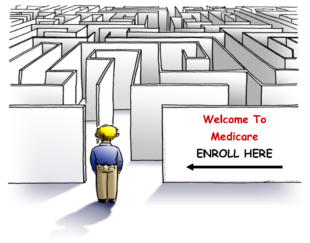

Medicare open enrollment is for people who are already enrolled in Medicare and want to change their plans. Revisit your Part B, your Part D plan and your supplemental plan and if you have that, your Medicare Advantage plan: since you first enrolled, your medical needs and medications might have changed and other plans might have lower prices. There can be a lot of price differences for drugs between the Part D plans. Go to Medicare.gov and find the plans available in your area.

If you’re signing up for Medicare for the first time, that has to be done around your 65th birthday. When you are working for a company with more than 20 employees you can continue to be covered by that plan, but best is to sign up for Medicare Part A, which is free. If you want Medicare coverage to start when your job-based health insurance ends, you need to sign up for Part B and D and buy most likely supplemental insurance (Medigap plan) or enroll in a Medicare Advantage the month before your other plan stops.

Even if you are not using any medications, once you sign up for Medicare, you also need to purchase a Part D plan. Plans can run as low as $7 per month, so it is cheap in comparison to a lifelong penalty if drug coverage is needed down the line.

The private health insurance market can be an equally difficult maze to navigate. Compare your employers’ plan offerings. You might have a choice between Preferred Provider Organization (PPO) and High-Deductible Health Plans (HDHPs). The PPO option typically has a lower deductible with higher premiums, while the HDHP option typically has higher deductibles with lower premiums and is commonly paired with a tax-advantaged health savings account (HSA) — a powerful savings and spending vehicle.

Funds in an HSA can double as an emergency savings account for qualified health care expenses. HSAs offer triple tax benefits:

- Contributions are not taxed (your employer might contribute part).

- Investment gains are not taxed

- And withdrawals for qualified medical expenses are not taxed, either.

Plus, when enrolled in a HDHP and HSA, you can choose to leave your funds in your HSA and, instead, cover a medical bill “out of pocket.” You can invest the money in investment funds your HSA is offering, but do this only if you are sure you will not need it within 5 years. You can keep it for medical costs in retirement.

All these choices are complicated. We can help you to navigate through this maze.

Anja & Clare